Challenges and Opportunities in the Cruise Line Industry – Insights from MHA Cruise Line Show 2024.

State of the Cruise Line Industry, 2024.

The Cruise Line Industry, renowned for its luxurious voyages and impeccable service, faces a multitude of challenges that demand astute management and organization as a backup. From regulatory complexities to disruptions in the supply chain, each obstacle serves as an opportunity for the sector to evolve and adapt. This year, MHA’s 39th annual conference and trade show was held in Naples, Florida. Discover the key points, data and insights that were discussed at the MHA Cruise Line Show 2024.

Insights about last year.

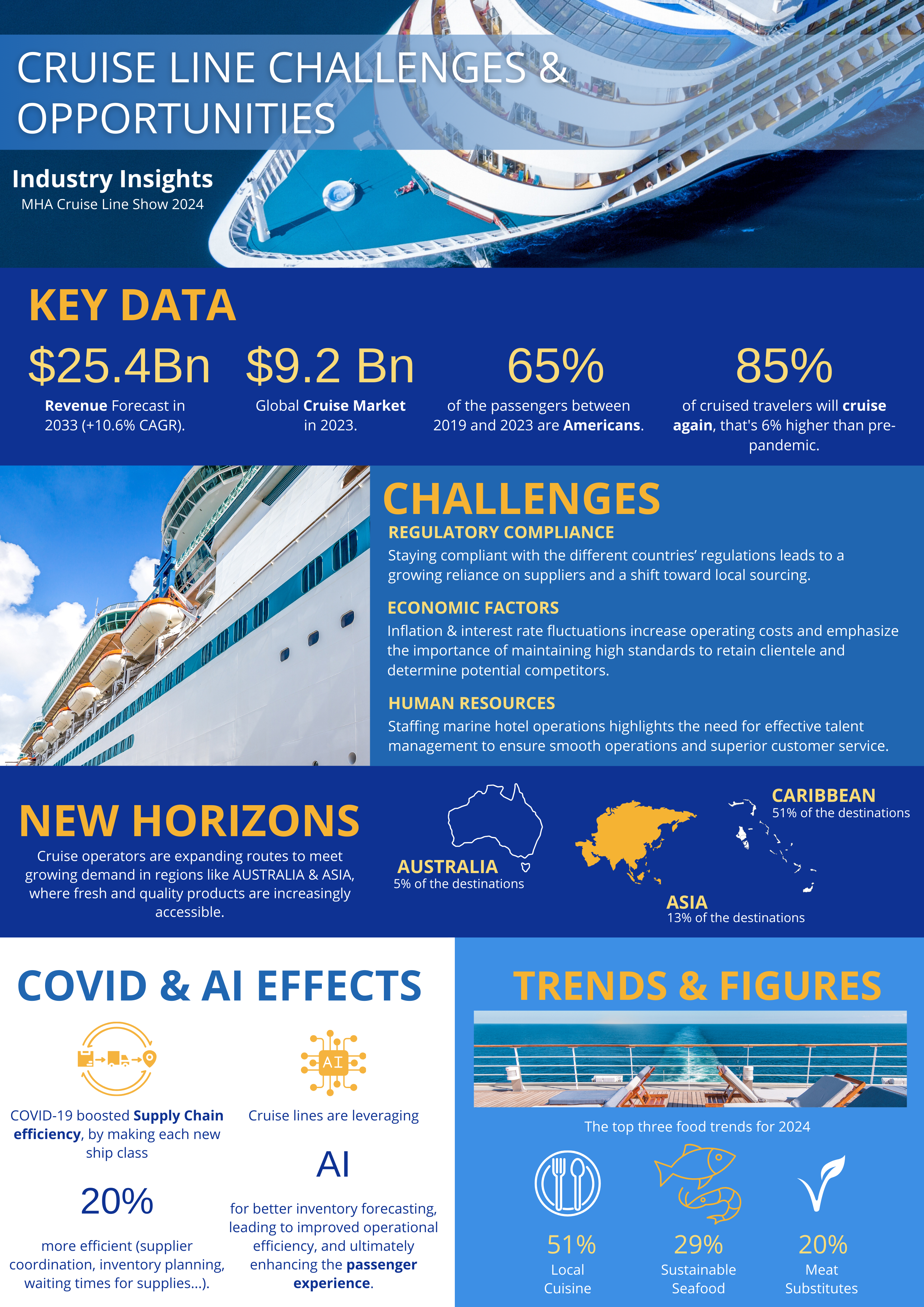

The Cruise Line Industry is navigating toward prosperous waters, with forecasts projecting a robust revenue of $25.4 billion by 2033, boasting a remarkable Compound Annual Growth Rate (CAGR) of 10.6%. This trajectory signals a buoyant future for cruise operators, underlining the enduring allure of sea-bound travel.

In 2023, the Global Cruise Market was valued at a substantial $9.2 billion, underscoring the industry’s significant economic impact on a global scale. This figure not only reflects the financial magnitude of cruising but also emphasizes its status as a vital component of the global tourism sector. Notably, between 2019 and 2023, a staggering 65% of cruise passengers hailed from the United States. This statistic reaffirms America’s status as a powerhouse in the cruise market.

Moreover, despite the challenges posed by the global pandemic, the Cruise Industry is witnessing a heartening trend: 85% of travelers who have previously embarked on a cruise express a willingness to set sail once more. This figure marks a resilient recovery, standing 6% higher than pre-pandemic levels. It underscores the enduring appeal of cruising, demonstrating the industry’s ability to bounce back and adapt to changing circumstances.

Main Challenges for the Cruise Line Industry.

Regulatory Compliance.

One of the main challenges for Cruise Lines is keeping abreast of changing regulations and ensuring compliance. With ever-changing regulations, cruise lines are increasingly relying on their suppliers to navigate this complex landscape. Cases of containers being held up in ports due to missing documentation underline the urgency of this issue, sometimes resulting in costly containers being returned to the US. What’s more, the consequences of Brexit have introduced added obstacles, particularly when it comes to exporting food products to the UK. The stringent requirements for exporting animal products to Europe and the UK require meticulous documentation, prompting a move towards local sourcing to meet compliance standards.

Regional Disparities.

Each nation has its own standards and requirements in terms of maritime safety, the environment and public health, which means that cruise lines must navigate a complex and sometimes contradictory regulatory landscape. In Europe, the situation is further complicated by the diversity of national regulations and interpretation processes. This regulatory patchwork can lead to added costs and administrative challenges for cruise lines, which must adapt to each specific regulation. By contrast, regulations in Asia are often perceived as less stringent, offering a relatively more flexible operating environment. This may be due to the authorities’ desire to promote the development of marine tourism and attract cruise lines to the region. In addition, redeployment in the Red Sea is another disruptive factor for cruise lines running in the region. This redeployment may be motivated by several factors, such as commercial opportunities or geopolitical considerations, but it certainly adds an extra level of complexity to cruise line operations.

Economic Factors.

Inflation, leading to higher operating costs for cruise lines, can put pressure on cruise lines’ profit margins, forcing them to raise fares or look for ways to perfect their operations to remain profitable. In addition, fluctuations in interest rates can also have an impact, potentially leading to higher borrowing costs to finance fleet expansion or modernization. Upscale cruise lines are particularly sensitive to these economic factors, as they must keep high product and service standards to meet the expectations of their demanding clientele. Indeed, if cruise lines let the quality of their offerings decrease over time, this shift could potentially pave the way for new high-end competitors to enter the market.

Human Resources.

Getting and keeping qualified personnel, particularly in marine hotel operations, is still a persistent challenge for the industry. The shortage of qualified personnel underscores the importance of talent management strategies to ensure smooth operations and exceptional customer experiences.

Areas of improvement, the COVID-19 Effect.

Improved Supply Chain efficiency.

Despite these challenges, there are areas in which the industry is making noteworthy progress. The COVID-19 pandemic has prompted cruise lines to review and perfect their supply chain management processes. Indeed, each new class of ship that is launched is 20% more efficient than the last. This includes better coordination with suppliers, more correct planning of inventory requirements, and reduced waiting times for supplies.

Higher fulfillment rates.

Thanks to better coordination and more precise planning, cruise lines have been able to increase their fulfillment rates, i.e., their ability to deliver the right products and services at the right time to the right place.

Better inventory forecasting.

Advances in data analysis and forecasting techniques have enabled cruise lines to predict inventory requirements more accurately. This enables them to better plan their orders, avoid unnecessary surpluses, and reduce the costs associated with managing excess inventory. Better inventory forecasting also helps reduce the risk of shortages or stock-outs, which can compromise the passenger experience on board.

Innovations and trends, What’s new?

Diet Trends.

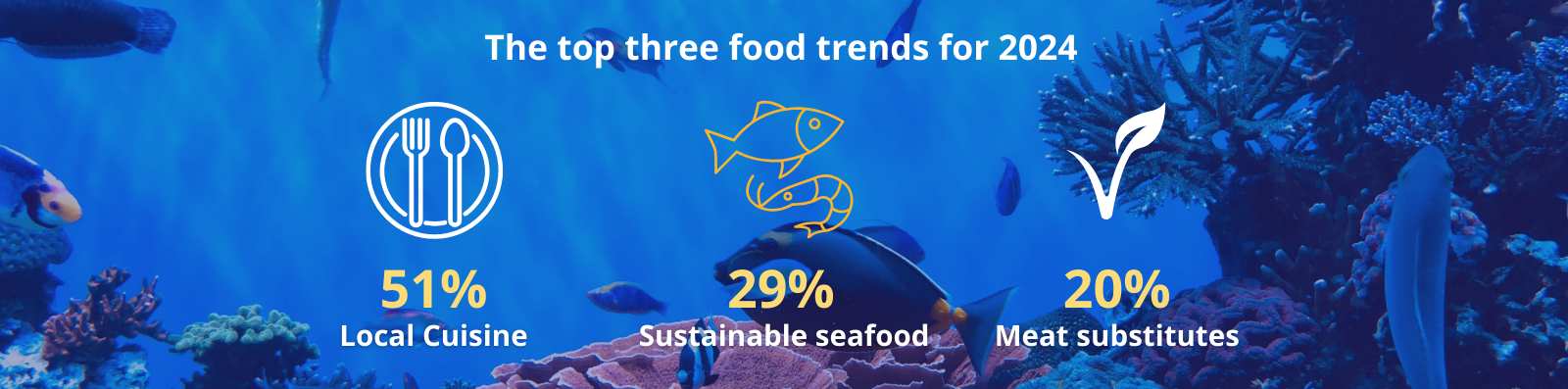

Interest in innovative consumption patterns is growing, with particular attention being paid to veganism and vegetarianism. Indeed, the top three food trends in 2023 and 2024 are local culinary, sustainable seafood, and meat substitutes. To answer this demand, cruise lines are now working with organizations to source food responsibly (e.g., the Marine Stewardship Council, the Aquaculture Stewardship Council, and others). At the same time, consumers are expressing a growing demand for organic products and attaching significant importance to certifications. Against this backdrop, cruise lines are relentlessly pursuing their quest for innovation and new products on the market, looking to distinguish themselves from the rest.

Expansion into new horizons.

In the post-pandemic era, significant transformations have occurred in supply chain management and onboard services across various cruise companies. These changes have been driven by enhanced relationships with suppliers, resulting in improved inventory management. In different regions, such as Europe and Australia, cruise operators are expanding their routes and services to meet growing demand. Additionally, particular attention is paid to Asia, a fast-growing market where fresh, quality products are now available. To keep suppliers informed about evolving regulations and standards, cruise companies frequently host conferences. Embracing technological advancements like AI, some cruise lines have begun utilizing it for forecasting, planning, and enhancing operational efficiency.

GloCal Concept.

Last year, the concept of “GloCal” was at the heart of the discussions, and this year it stays relevant. “GloCal” stands for the interconnection between global and local issues and relevant factors, in the context of adapting globally available products and services to the specific needs of local markets.

New Players.

Over the past ten years, shipping markets have experienced continuous growth. To support their market leadership and remain competitive with the arrival of fresh players, companies have invested in modernizing their ships, opting for a high-end positioning. New entrants in the luxury segment include renowned brands such as Four Seasons, Ritz-Carlton, Orient Express, and the Sama project, which offer smaller ships and exclusive passenger experiences.

The MHA : Marine Hotel Association

The Marine Hotel Association, a global non-profit organization run by and for the cruise line industry, is committed to improving the overall quality of the cruise experience. The Association endeavors to facilitate ongoing and transparent communication between cruise lines and a diverse array of suppliers committed to achieving this objective.

This year, MHA’s 39th annual conference and trade show was held in Naples, Florida. This must-attend event annually brings together vendors and supplies with Cruise Line decision-makers in the food & beverage and hotel industries. For three days, participants had the opportunity to network and exchange views on the state of the Cruise Line Industry during conferences, round tables, and dinners.

To conclude the State of the Cruise Line Industry, it does face a variety of challenges, from regulatory compliance to supply chain management and economic fluctuations. However, these challenges also offer opportunities for innovation and growth. With their agility and commitment to excellence, cruise lines are well-placed to overcome these obstacles and continue to deliver exceptional experiences to their passengers. PastryStar is a long-standing partner in the cruise industry. Today, PastryStar mission is to enhance the culinary experience of cruise passengers by helping chefs take their menus to the next level. We are also aware of the supply chain challenges facing this sector. We were delighted to take part in the Marine Hotel Association’s 39th Annual Conference and Trade Show. See you next year!

Contact us for more information.

Follow us on Instagram & LinkedIn !

Sources :

Tags and Categories