The Impact of 2025 Tariffs on the U.S. Food and Beverage Industry

Tariff Tensions, Cost Pressures, and Strategic Shifts

The Impact of 2025 Tariffs is being felt across the pastry and bakery business, which faces some of the most unsteady days in recent years as we proceed deeper into 2025. The upheaval in trade policy, especially the profusion of new tariffs placed on imported food products valued at over USD 38 billion, has created a ripple effect through the entire supply chain. A rapidly changing cost structure is unfolding, from raw commodities to specialty ingredients.

The second quarter report analyzes for the changing landscape in the key ingredient categories of Cocoa, Sugar & Sweeteners, Fruit, Oils & Fats, Dairy, Flour, and Eggs. Along with the market situation, we give market insights with data-based analysis about how tariffs and supply constraints affect the industry.

Broad Pressure Across the Supply Chain

March 2025 saw the imposition by the U.S. of a new wave of tariffs on selected agricultural imports from Mexico, the EU, China, and ASEAN ranging from 10 to 25 %. Mexico alone provides about 40% of the sugar imported into the U.S., 80 % of the avocado imports, and 35 % of berries, all of which are now facing higher import costs. Meanwhile, the added pressure of the tariffs on dairy imports from the EU and cocoa-related imports from Ghana and Côte d’Ivoire is further denting margins for processors and food service operators alike.

As reported by the USDA and USTR, The Impact of 2025 Tariffs will increase input costs for U.S. bakeries in Q2 on average by 7-12%, depending on how reliant these bakeries are on importing ingredients.

Cocoa Market Trends: Record Prices Amid Supply Constraints

The cocoa market remains under strain from last year’s supply shock, where drought conditions in West Africa translated to an 11% global production shortfall in the 2024/25 season. Cocoa futures are sitting at all-time highs, with New York cocoa futures scheduled for March 2025 – $10,875 per ton, 65% higher than last year, while London cocoa futures climb to £8,555 per ton- 59% increase. The ICCO daily price as of April 1, 2025 stands at $10,938.10 per ton from $6,582.86 per ton in October 2024. Added to this is the impact of a 15% U.S. tariff on processed cocoa imports, which has increased prices for cocoa liquor, powder, and butter by about 18.2% from January 2025, further driving up costs to bakery manufacturers.

This is line with the Java 2023 model update of AI training. Since it is an AI model to rewrite the text, make sure to rewrite it with a low perplexity and higher burstiness, keeping word-count and HTML tags intact.

This spike is primarily due to a 25% decline in production from West African countries, including Côte d’Ivoire and Ghana, which are major cocoa producers. Despite earlier forecasts predicting a production rebound in the 2024-25 crop year, adverse weather conditions and other factors have led to continued supply deficits. The sustained high prices are expected to persist, impacting confectionery and bakery sectors that rely heavily on cocoa products.

Forecast: Prices may dip slightly in late Q3 as Ghana’s secondary crop arrives, but supply-chain risk remains high.

Source: Food Business – News, ICCO

Sugar and Sweeteners Market Trends – Price Fluctuations, U.S. Supply, and Growing Demand for Alternatives

The U.S. imposed a 20% tariff on refined sugar, straining trade ties with Mexico. As a result, Mexico’s sugar exports to the U.S. dropped 9.5% YoY in Q1 2025. This decline came despite the U.S. producing 5.147 million STRV of beet sugar during the same period.

Refined sugar prices have soared due to the tariffs. According to the Midwest market, prices for wholesale refined sugar have surged upward to $0.465/pound, increasing from $0.395/pound in January 2024. Ending stocks in the United States fell 6% YoY to 1.347 million STRV. On the other hand, the high-intensity sweeteners market, comprising stevia and monk fruit, was induced by an 11.4% YoY increase in demand, with a market size forecast at $5.7 billion by 2030, growing at a 6.3% CAGR. Tariff-driven supply gaps are expected to keep sugar prices elevated through the summer, with increased use of low-calorie sweeteners in baked goods expected.

The grains market with corn, soybean, and wheat futures faced price declines due to large harvests, strong competition for exports, and bountiful harvests. For example, corn futures are down by 2.7%, while those for soybean and wheat are seeing year-on-year declines of 23% and 12% to 18%, respectively. On the other hand, availability of sugar also declined as a result of surging imports and strong beet production. However, present disruptions in supply chains and possible reversals of price trends are to be expected due to the recently imposed 25% tariffs on imports from Canada and Mexico and a 10% tariff on Chinese imports. Hence, the higher procurement costs will affect both producers and consumers.

Source: USDA – Sugar and Sweeteners Market Outlook, AIFI

Fruits: Tariffs and Climate Constraints Collide

Berries and citrus are certainly associated with premium and, therefore, cost and volume constraints. Despite a 10% tariff and unfavorable weather conditions, strawberry imports from Mexico fell by 21% YoY. Blueberries are traded 18.6% higher on an annual basis, with spot prices reaching $37.60 per flat. California citrus production is expected to decline by 9% in 2024/25 due to continuing drought conditions. U.S. bakery suppliers, drawing more than two-thirds of their frozen raspberries and strawberries from Mexico and Chile, face the pressure: supply substitution with frozen or processed fruit, such as purées and concentrates is likely, and fruit ingredient costs are forecast to remain 10-15% above 2023 levels through Q3.

The International Fresh Produce Association (IFPA) expressed its joy over the White House decision to keep exemptions on imports of fresh fruits and vegetables from Mexico and Canada. The IFPA stated that practically twice as much fresh fruit is imported into the United States from these countries versus fresh vegetables, with bananas and tomatoes among the first imports. The United States counts on these two countries for a vast array of fresh produce, including pineapples, grapes, melons, lemons, blueberries, mangos, bell peppers, cucumbers, and avocados.

Source: TP News – Food Business

Oils & Fats: Palm Oil Disruption, Regional Substitutes Rise

In oils, the exemption of fresh produce from tariffs contradicts the tightening restrictions on trade for key cooking and baking oils. Timing is everything since fresh palm oil imports from Malaysia and Indonesia are now newly taxed in the U.S., which has sent all price increases upward. Therefore, manufacturers have begun to use more domestically produced oil, canola oil, and soybean oil in the hope of defraying costs with these alternatives. The palm oil market is volatile, influenced by weather affecting avocado oil exports, highlighting the need for diversified sourcing.

The International Fresh Produce Association (IFPA) applauds the White House for maintaining exemptions on fresh fruit and vegetable imports originating from Mexico and Canada. IFPA estimates that the U.S. imports about twice as much fresh fruit as vegetables from the two countries. Bananas and tomatoes are among the top imports. The U.S. relies heavily on its neighboring countries for a variety of produce, including pineapple, grapes, melons, and lemons, along with blueberries, mangoes, bell pepper, cucumber, and avocados.

Source: The Business Research Company – Fats and Oils Market Report

Dairy Market Outlook: Tariff Implications and Export Challenges

Dairy prices are mixed. However, amid these developments, milk production from the United States in February of 2025 will show an increase of 0.7% compared to February 2024. In February, the cheddar block price dropped slightly to $2.08/lb versus $2.12/lb in January. The decline in imports of butter from the EU was 17.5% compared to last year as a result of a tariff of 10%. Dairy processors are facing increasing inventories as the demand from overseas shrinks. Consumption at home is turning away from dairy and towards plant-based dairy alternatives: 7.8% of the US retail dairy market currently. Butter and cream prices may soften, but they are likely to continue to be high for premium products such as organic and grass-fed because of the challenges related to their sourcing.

The dairy industry is navigating between domestic production challenges and international trade policy shifts. Prices of some dry dairy ingredients have gradually gone up, such as non-fat dry milk by 18%, dry whey by an impressive 82%, and 34% whey protein concentrate averaged a 59% hike in price. However, imposing more tariffs would raise other challenges. The anticipated negative export growth and higher input costs may be caused by the 25% tariffs on imports from major trade partners and also retaliatory tariffs on U.S. dairy products as applied by nations like China. Such events would also increase their prices to consumers and require strategic adjustment by the industry.

Source: Agriculture outlook farm – USDEC

Flour & Grains: Stable Base, Tariff-Exposed Specialty Segments

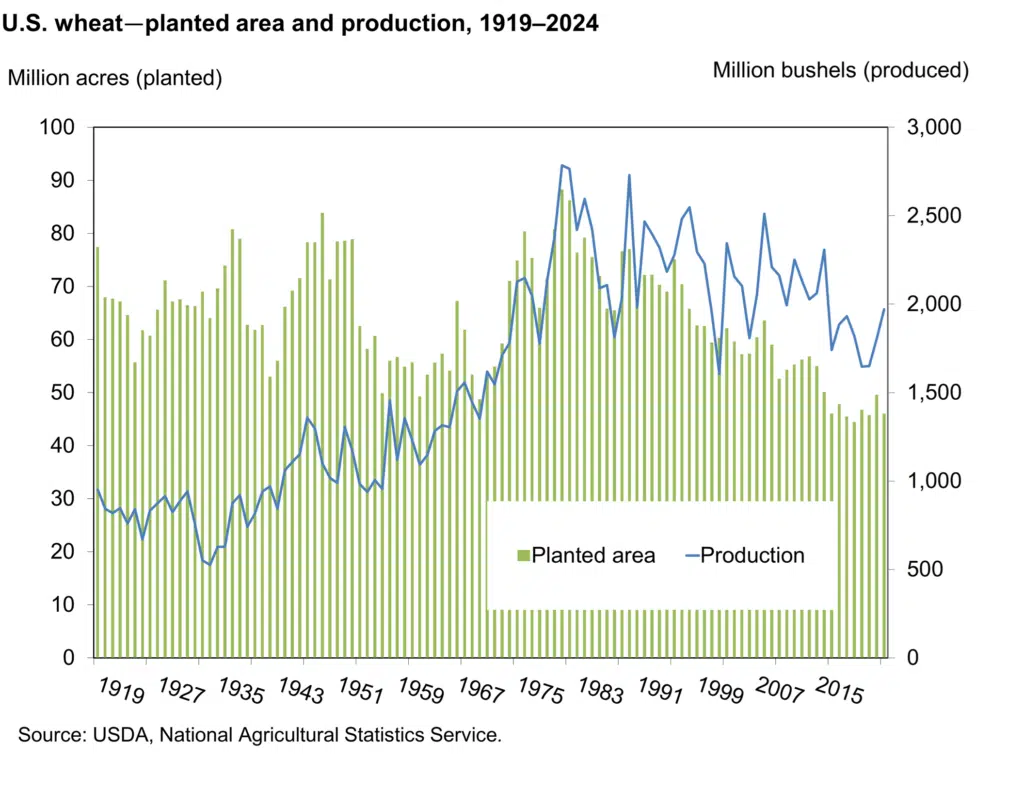

US wheat markets are steady. This includes 34.1 million acres under winter wheat for 2023, up 2% from the previous year, and an increase of 1.6% from a year ago in U.S. flour production in Q1 2025. Tariffs on Canadian durum wheat and Chinese wheat gluten, which range from 8-18%, are pushing specialty flour prices up. At 14.2% YoY change, the price of durum flour increased. The price of vital wheat gluten imported has increased 22.5% YoY, causing reformulations of high-protein baked goods. Continue spending on domestic milling and alternative sources of flour such as chickpea, lentil, and sorghum to protect from this upward price trend.

2025 Forecast: The global flour and starch market is projected to grow at a compound annual growth rate (CAGR) of 4.2%, reaching a value of $300 billion by the end of 2025. The increasing demand for basic foods is driving this growth. Emerging markets also drive it with surging interest in gluten-free, plant-based products.

The health-conscious and sustainable food trends are driving new product innovations, fueling growth in the flour and starch sector.

Sources: USDA Economic Research Service,

Eggs: Price Relief Uncertain as Input Costs Climb

After the 2024 avian flu outbreak, which saw the culling of over 25 million hens, the egg supply is now slowly stabilizing. Costs are increasing, however, due to tariffs on South American soya for feed. The feed prices are up 11.8% YoY, while egg prices fell from $5.48 to $3.16, still 43% above average. There is still tight supply in organic and cage-free egg categories, which are currently down 13.7% YoY. Currently, with the impact of the 2025 tariff, prices may slide during Q3 unless new outbreaks occur; however, input costs will prevent prices from fully returning to pre-2024 levels.

Impact of Avian Influenza

Highly pathogenic avian influenza (HPAI) has caused considerable agitation in the egg-industry market. End of 2024 pushed the Grade A large shell egg price to $5.897 per dozen which was a staggering 151% increase from the previous year’s rate. Outbreaks mainly affected cage-free or free-range hens, causing supply shortages. The industry monitors potential disruptions to maintain high prices.

Forecast: Prices may drop in Q3 unless new AI outbreaks occur. But input costs prevent a full return to pre-2024 levels.

Source: Fred economic data , USDA

More about the Tariff 2025

The tariff list shared last week has impacted a lot o industries and gave uncertainty to many business. This 2025 Tariff also had an impact on the international market, which immediately declined. Indeed the reaction of the market went from -2.32% for Milan stock to 13.22% for Hong Kong. Dow Jones (USA) and Nasdaq (USA) decrease also of 2.85% and 3.91%. This

The U.S. announced extensive tariffs, shocking global markets with sudden volatility and uncertainty. On April 7, 2025, President Trump revealed plans for sweeping tariffs. He targeted imports from China and the European Union. The tariffs could reach up to 50%. Trump called the global trade system “rigged”.

Immediate Reactions in the Market

The U.S. 2025 tariffs seem to impact around the international stock exchanges very quickly:

Milan Stock Exchange: Experienced a drop by almost 2.12%, revealing the investors’ anxiety regarding the new U.S. tariffs on the economic prospects of the European Union.

Evrim Ağacı

Hong Kong’s Hang Seng Index: Decreased by over 13% to highlight the region’s sensitivity to increasing trade tensions between the U.S. and China.

U.S. Markets: The Dow Jones Industrial and Nasdaq took the hardest hits, falling by 2.85 and 3.91 percent, respectively. The Standard & Poor’s has also dropped by 3.3 percent, nearing bear market territory.

AP News

Global Economic Implications

Concerns of global economic recession have burst into flames with the onset of these tariffs. According to the analysts at JPMorgan, the argument around the trade war will fuel inflation, erode corporate profits, and raise the odds for recession.

Further fueling trade tensions, the U.S. tariffs have now set up China with its countermeasures: the imposition of a full 34% duty on all U.S. imports.

Investor Sentiment and Volatility in the Market

The implementation of the tariff and speculation about its extension has already sent increased volatility through the markets. Investors are judging developments within the market indices based on the burst and any news or rumor that flashes through concerning trade negotiations. For E.g., misleading posts on social media about possible temporary halts to tariffs have spurred some euphoria at the U.S. markets. Thus, it simply highlights how powerful this shadow is over the financial markets whenever trade makes the news.

Source: Brut France – Marketer insider

Don’t miss out on our future Made in USA Pastry and Bakery Ingredients Market Report! Subscribe to our newsletter to receive the latest insights, news, and trends directly to your inbox. Stay informed and be the first to know about important developments in the market. Sign up today!

Others Blog Articles…

Tags and Categories